Work Comp Insurance 101 – A Complicated Insurance Explained Clearly

I regularly speak to business owners that are purchasing workers compensation coverage for the first time. Most insurance agents do not take the time to explain how the basic process works. When this happens, business owners are purchasing a coverage they don’t clearly understand. It can lead to frustration on the part of the business owner and the insurance agent when something changes with the policy. Especially when the change demands more money. Work Comp Insurance is my niche. I make sure to take the time to explain the basic process of how premiums are developed at the beginning of the policy period and after the policy period ends. I feel it’s important to explain this coverage properly. By doing this I find that business owners understand why changes happen and what changes are important to pay attention to. I also make sure they know to notify their agent or insurance company throughout the policy period if any of these changes occur.

The Basic Process:

Workers compensation rates are first dictated by the workers compensation classification code. Every industry does not have a specific code. A lot of times the process of how the work is completed is assigned to a work comp insurance code where the process is similar. For example, a business that puts waterproof coatings on parking lots would be classified the same as a painter because the process is similar.

After the workers compensation classification code is determined, in nearly every state the insurance company is able to file their rates depending on how competitive they want to be in an industry. The state typically sets the minimum and maximum rates, insurance companies file their rates within the range.

Work comp insurance policies require that business owners declare an estimated payroll for all covered persons for the annual policy period, 12 months from the date the policy begins. Business owners are tricky because states require that business owners are covered using a minimum annual payroll up to a maximum. If a business owner is included in coverage and takes less compensation than the state minimum, the additional payroll is added after the audit. If a business owner takes more than the maximum set by the state, then wage calculations stop at the maximum.

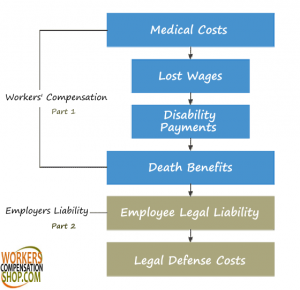

The total policy premium is determined by several factors. First the rate per $100 of payroll established by the insurance company per work comp insurance code. That rate is a percentage of the gross wages paid to employees in each workers compensation code. Second, different states can charge different taxes that are added to the bottom line. The insurance company typically charges an expense constant factor that is a flat fee. Then, the insurance company can apply credit or debits (discounts or increased pricing). All of these factors determine the final pricing when you activate coverage.

After the Workers Compensation Policy is finished a payroll audit must take place. The purpose of this audit is to determine the actual gross wages paid to covered persons throughout the policy period. Also, the auditor will double-check the work comp insurance classification codes for accuracy. If the agent used the incorrect workers compensation code OR something changed throughout the policy period, the auditor will adjust the workers compensation code. It’s very important to verify the workers compensation code for your business before purchasing a workers compensation policy. Your agent should be able to provide a detailed description of your workers compensation code to verify accuracy.

During the audit process, most insurance companies do not have the ability to staff auditors across the U.S. so they use 3rd Party companies to handle their audits. These 3rd Party auditors typically specialize in workers compensation audits for multiple insurance companies. Typically the auditor will make contact with the business point of contact within 60 days after the policy period has expired. It’s very important to set-up the audit as soon as you can coordinate schedules, make this a priority. The auditor will inform of the payroll documents needed, have all of them prepared. These auditors are required to complete the audit process within a small timeframe otherwise they return as non-productive. When an audit is returned as non-productive, the insurance company will process and mail to the business owner an “estimated audit” with a balance due and a cancellation notice. The business owner must contact the insurance company to re-open and process the audit. This is typically a headache, it’s a lot easier to make it a priority and take the necessary time to complete it.

After the audit is processed you will receive the results and either a balance due or a credit being returned. At this point the business owner should review and file a dispute with the insurance company IF the results are incorrect. The auditor’s duties are to capture the gross wages for covered persons and verify job duties. Auditor’s make mistakes, don’t ask the appropriate questions and sometimes they are new to the industry therefore, do not know all of the rules. I know these to be the truth, I speak with the auditor’s for clients frequently. Before filing the dispute the business owner should request the auditor’s notes from the insurance company to understand how they arrived at the results. Then, the business owner can file the dispute with the insurance company if there is an argument.

There are several rules within the workers compensation industry that surprise owners after audits are complete. The audit’s purpose is to accurately charge the owner based on what happened during the policy period. Workers Compensation audits are determined by the 4 bullets below:

- Gross Wages for Employees of the business (no surprise here).

- Gross Wages for Uninsured 1099 sub-contractors. This is the most common surprise. 1099’s is discussed further below.

- Proper Classification Codes per employee job duties.

- INCLUDED Business owners. In most situations, business owners are allowed to choose whether they want to be Included or Excluded in the workers compensation coverage. When a business owner chooses to be included, the State typically determines a minimum and maximum wage threshold. Rules for whether or not a business owner can be included/excluded and wage thresholds are determined by Entity Status (Individual, Partner, LLC, Corporation). If a business owner changes entity status during a policy period, it’s important to notify your workers compensation agent to determine if different rules apply. Otherwise, all adjustments are made at audit.

Uninsured 1099’s

This is one of the most common surprises for business owners after the audit is completed, especially in the construction industry. Uninsured 1099’s are added to the workers compensation policy based on the classification of work the 1099 is performing. Even if the state doesn’t require the 1099 to purchase workers compensation coverage, the only way for a business owner to exclude 1099’s from their policy audit is to collect a certificate of workers compensation coverage OR a “state approved exemption”.

It’s important to understand when a business owner can treat a 1099 like a true independent contractor and request a work comp insurance certificate.

1099 must use their own tools/equipment

1099 must drive their own vehicle

Contractor cannot determine when and where the 1099 is working. Must assign a project and let the 1099 execute on their own time.

1099 must also perform work for their own customers

1099 must carry appropriate licenses with state when required

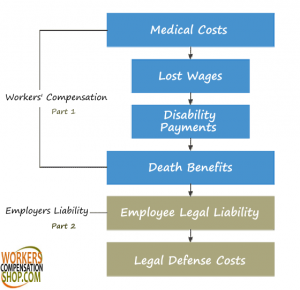

These workers’ compensation systems are administered by each individual state and not the federal government. Because of this, each state provides the system a tad bit different. Wisconsin was the first state to administer a workers’ compensation system in the year 1911. Mississippi was the last state to come around to the exclusive remedy in 1948.

These workers’ compensation systems are administered by each individual state and not the federal government. Because of this, each state provides the system a tad bit different. Wisconsin was the first state to administer a workers’ compensation system in the year 1911. Mississippi was the last state to come around to the exclusive remedy in 1948. The term ‘

The term ‘ As time has passed and work environments have changed so has the opinion of many in the business community about the need for an exclusive remedy in todays’ business climate. A few states have removed workers compensation as a requirement for some types of businesses. A few other states have proposed the idea, but are still in a wait and see approach. At this time Texas and Oklahoma re the only states to implement what is referred to as an Opt-out program. This is a program where if the business qualifies they can elect not to carry coverage and provide an alternative to what most states give through the workers comp exchanges. Both have in place certain minimum standards that are similar to those standards required under most workers compensation systems. Opponents of these system frequently critique that there are very strict reporting policies put on the responsibility of the employee. In the system set forth by Oklahoma employees must report the injury to management within 24 hours or they may not be eligible for coverage. Most states are sitting in a wait and see approach and depending on the success or failure of these states will determine the future of the workers’ compensation system.

As time has passed and work environments have changed so has the opinion of many in the business community about the need for an exclusive remedy in todays’ business climate. A few states have removed workers compensation as a requirement for some types of businesses. A few other states have proposed the idea, but are still in a wait and see approach. At this time Texas and Oklahoma re the only states to implement what is referred to as an Opt-out program. This is a program where if the business qualifies they can elect not to carry coverage and provide an alternative to what most states give through the workers comp exchanges. Both have in place certain minimum standards that are similar to those standards required under most workers compensation systems. Opponents of these system frequently critique that there are very strict reporting policies put on the responsibility of the employee. In the system set forth by Oklahoma employees must report the injury to management within 24 hours or they may not be eligible for coverage. Most states are sitting in a wait and see approach and depending on the success or failure of these states will determine the future of the workers’ compensation system.

A lot of insurance carriers have restricted coverage for non-profit and charitable organizations due to a large amount of historical claims and their potential exposure from volunteers serving these organizations. A few carriers have taken a different approach to non-profits and created programs designed specifically to the unique needs of these businesses. Below is a list of six coverages most non-profits will need.

A lot of insurance carriers have restricted coverage for non-profit and charitable organizations due to a large amount of historical claims and their potential exposure from volunteers serving these organizations. A few carriers have taken a different approach to non-profits and created programs designed specifically to the unique needs of these businesses. Below is a list of six coverages most non-profits will need.

Owners and Officers Coverage is for defense costs and damages (awards and settlements) arising out of wrongful act allegations and lawsuits brought against an organization’s board of directors and/or officers. Securing this coverage allows your officers to sit on your board and comfortably know they are not going to be liable for the actions of the organization.

Owners and Officers Coverage is for defense costs and damages (awards and settlements) arising out of wrongful act allegations and lawsuits brought against an organization’s board of directors and/or officers. Securing this coverage allows your officers to sit on your board and comfortably know they are not going to be liable for the actions of the organization.