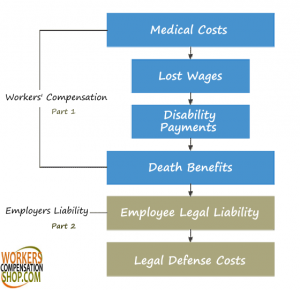

Most business owners are familiar with workers’ compensation insurance. However, many do not know it almost always comes in two parts. There is workers’ compensation coverage and employer’s liability coverage. Workers’ compensation coverage has unlimited benefits for covered claims where as employer’s liability insurance has limits to its benefits. Employer’s liability insurance protects employers from claims caused by workplace conditions or practices which are not covered by workers’ compensation coverage.

Employer’s liability claims are very rare. However, they can occur and are often costly when they occur. Employer’s liability coverage can cover damages, judgments, settlements, legal defense fees, and other court costs. Increased employer’s liability limits generally only increase the cost of the workers’ compensation insurance policy by around 1%. Employers liability coverage is part of every work comp policy. You may be able to increase or decrease the amount of coverage (and the cost) based on your needs and risk exposure. This is a good reason to partner with an experienced independent insurance agent because they will be able to advise on how much coverage your business actually needs.

The most common types of employer’s liability limits are as follows:

- Third Party Claims

- Dual Capacity Claims

- Loss of Consortium

- Consequential bodily injury

- Intentional acts/torts by the employer

(1) Third party claims: these are generally claims brought by an injured employee against a manufacturer of the object causing the employee’s injury. The manufacturer then brings a claim against the employer for contributory negligence.

(2) Dual capacity claims: Dual Capacity Claims are similar to Third Party Claims, but it comes up when the employer is also a manufacturer. If an employee is injured by a defective product manufactured by their employer, they might bring a product liability claim against the employer in addition to claiming workers’ compensation benefits.

(3) Loss of consortium or other services to family members: loss of consortium and other claims such as modifications to homes or lost parental services resulting from a workplace injury can be covered.

(4) Consequential bodily injury: claims by a spouse or other family member of an injured employee arising from the injury such as a heart attack due to the stress of the news of the employee injury. It is common for these types of claims to include alleged mental injuries. Legislative action in many states has narrowed the applicability of this type of lawsuit so it is important to know the laws within the state or states that your business operates in.

(5) Intentional acts/torts by the employer: claims covered in some jurisdictions such as knowingly allowing employees to work in unsafe workplace conditions.