For many business owners, purchasing insurance is a foreign concept. Like many industries there are terms only the insiders know and they frequently use when discussing the policies. Here is a list of 20 terms that will give you a leg up the next time you are purchasing or renewing your commercial insurance policy.

Insurer – a person or company that underwrites an insurance risk; the party in an insurance contract undertaking the risk to pay compensation.

Insured – a person or organization covered by an insurance policy.

Peril – the possibility that you will be hurt or killed or that something unpleasant or bad will happen. exposure to the risk of being injured, destroyed, or lost.

Premium – An amount to be paid for an insurance policy. It is an amount paid periodically to the insurer by the insured for covering their risk.

Deductible – A deductible is the amount you have to pay out-of-pocket before the insurance company will cover your remaining costs.

1st person liability – First person liability is for damage that is done to you or your business. A good example of this would be a commercial property insurance policy. This policy covers the damages to you and your property. It does not cover the damage to another persons’ property or if they are hurt on your property.

3rd person liability – Third person liability is liability that you or your business has to other third parties. Third parties can include customers, vendors, other businesses or anyone who may be harm by the actions of you or your business.

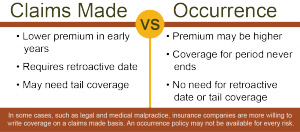

Claims-made policy – A policy written on a claims-made basis means that if the insurance is in place when the claim is made, but not when the occurrence took place than the insurer responsible for the claim is the insurer when the claim is made. This is common for professionals like a lawyer or an engineer. In these professions a claim is frequently filed months if not years after the occurrence takes place. At that time the insured may have coverage with a different company and there may be some discrepancy between who is responsible for the claim.

Occurrence based Policy – A policy written on an occurrence basis means that the insurer responsible for the claim is the insurer who was in place when the occurrence took place. If an engineer works on a house and there is a problem with the house years later than the insurer responsible for the occurrence is the insurer that was in place when the occurrence took place.

Endorsement – an endorsement is a document attached to an insurance policy that amends the policy in some way. An endorsement may add, remove or alter the scope of coverage under the policy.

Negligence – Negligence in relation to insurance means a person or business did not demonstrate appropriate amounts of care or responsibility for a particular situation. The failure to take appropriate precautions can cause you to be considered liable for the damage. This can also be referred to as the failure to use a degree of care considered reasonable under a given set of circumstances. Liability policies are designed to cover claims of negligence.

Named Insured – Any person, business or organization who is specifically named as an insured on an insurance policy. This is different from entities who although unnamed may fall within the policy definition of an insured.

Ordinance or Law Coverage – Coverage for loss caused by the enforcement of an ordinance or law regulating construction and repair of a damaged property. Older structures that are damaged may need to be upgraded in regards to electrical, plumbing, venting, etc. A typical commercial property insurance policy does not pay for these additional cost. This policy is an endorsement on top of your commercial insurance policy and will cover the additional costs needed to bring the new building up to date.

Hammer Clause – A ‘Hammer Clause‘ is a provision within an insurance policy that gives the insurer the right to settle for an undisclosed amount and if the insured does not agree to the settlement than they take on some or all of the risk. In some cases, the insured takes on all of the risk, but in many cases it is 70/30 or 50/50.

Hammer Clause – A ‘Hammer Clause‘ is a provision within an insurance policy that gives the insurer the right to settle for an undisclosed amount and if the insured does not agree to the settlement than they take on some or all of the risk. In some cases, the insured takes on all of the risk, but in many cases it is 70/30 or 50/50.

The Assigned Risk Provider (Also known as the pool or the state fund) – The assigned risk provider applies to workers’ compensation coverage. It is the provider of last resort within each state for businesses who cannot obtain coverage on the open market. The business may not be able to obtain coverage for a number of reasons. Typically, it is because of the small size of the company or because of their loss history. The Assigned Risk Provider offers coverage at a higher rate and typically once you are in the pool you must stay in the pool for 2-3 years.

Business Owners’ Package (BOP) – A business owner’s policy, commonly referred to as a BOP, combines several lines of coverage built into one policy. They are often better suited for small business owners because they offer targeted coverage options designed for specific types of businesses within certain industries. They are usually less expensive then purchasing coverage separately because the business is purchasing multiple policies for liability, property, commercial auto, etc.

Artisan Contractor – This term refers to businesses in several different industries. It includes many occupations that involve skilled work with tools at the customer’s premises. Carpenters, plumbers, electricians, roofers and tree surgeons are some professions that would be included in this group of businesses. Also included are diverse other skilled service providers, such as interior decorators, piano tuners and exterminators.

Artisan Contractor – This term refers to businesses in several different industries. It includes many occupations that involve skilled work with tools at the customer’s premises. Carpenters, plumbers, electricians, roofers and tree surgeons are some professions that would be included in this group of businesses. Also included are diverse other skilled service providers, such as interior decorators, piano tuners and exterminators.

Loss History – Loss history is a documented history of damages or losses connected with a given asset. It is a way for the insurance carrier to determine the amount of claims your business has against an insurance policy. They use it to determine how much premium to charge or if they are willing to take on the risk altogether.

Inland Marine Insurance – Inland Marine Insurance is property insurance for property that is likely to be in transit over land. Many inland marine coverage forms provide coverage without regard to the location of the covered property; these are sometimes called “floater” policies. As a group, inland marine coverage forms are generally broader than property coverage forms.

Umbrella Coverage – The umbrella policy serves three purposes: it provides excess limits when the limits of underlying liability policies are exhausted by the payment of claims; it drops down and picks up where the underlying policy leaves off when the aggregate limit of the underlying policy in question is exhausted by the payment of claims; and it provides protection against some claims not covered by the underlying policies, subject to the assumption by the named insured of a self-insured retention (SIR).

Umbrella Coverage – The umbrella policy serves three purposes: it provides excess limits when the limits of underlying liability policies are exhausted by the payment of claims; it drops down and picks up where the underlying policy leaves off when the aggregate limit of the underlying policy in question is exhausted by the payment of claims; and it provides protection against some claims not covered by the underlying policies, subject to the assumption by the named insured of a self-insured retention (SIR).